By Chris Rowe

Hi…

If the two-week long December downturn in the stock market has got you down… you’re not alone.

And I totally get that it can be scary to hold onto stocks – and even harder to buy them – at this particular time.

That said, today I’ll show you why right now you can ignore the most recent Sell signals and either…

Resist the urge to sell out of your bullish positions, or, better yet…

Use this first Sell signal off a bear market bottom as a buying opportunity and be a buyer of stocks

These are not sentiments you’ll see in the mainstream financial media. But trust me – ignoring the first Sell signal after a bear market bottom is almost certainly the right move to make right now.

At a bear market low, the economic news is always ugly and sentiment is always negative. That’s one of the key characteristics of a bear market low.

When people see that first sell signal, they freak out and make the mistake of exiting the market. But that’s almost always the very best time to step in and buy.

In fact, from a stock market low into the next bull market is when we see the sharpest gains. And it’s also when we see the absolute worst news.

Since the economic news is dire and the geopolitical situation is scary, and since gas prices are high and the Federal Reserve is saying they’re going to keep increasing the cost of borrowing…

The mood of everyone from the greenest DIY investor to the most seasoned veterans is — negative.

How do we define “bear market bottom?”

We use the granddaddy of all technical indicators – the New York Stock Exchange Bullish Percent Index (NYSE BPI).

When this indicator moves below the 30% level (shaded in red, below) the market is oversold or washed out.

The black arrows point to the most recent times the market was oversold in 2022 — in June and October.

(For more detail on the NYSE BPI, visit our free webpage TrueMarketInsiders.com, dedicated to important changes in this indicator.)

By the way, this rule – ignore the first Sell signal off a washed out, bear market bottom – applies to all technical indicators, not just the NYSE BPI.

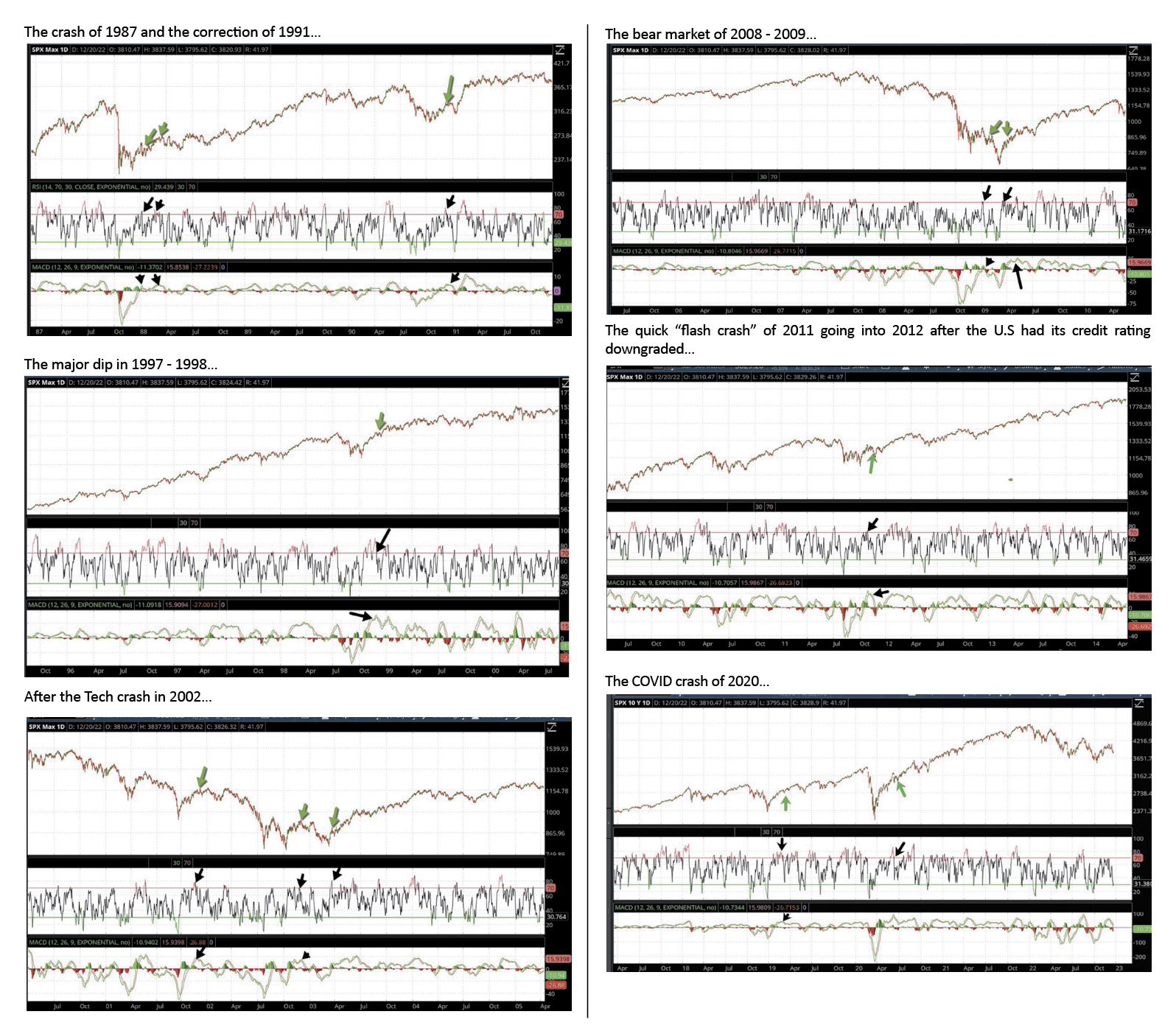

And this rule was not arrived at because of any “theory.” You can see it operate in real life at real bear market market bottoms.

In all of the examples below, we saw the BPI get oversold before reversing higher.

Then, the first Sell signal we got turned out to be a great buying opportunity.

In these examples, I show two of the most popular indicators – the RSI and the MACD.

You don’t need to know the nuts-and-bolts of those indicators to see how the market behaved at their respective bear market bottoms. The black arrows show the Sell signals and the green arrows show the S&P gunning higher.

To sum up: No matter how scary it might seem… NOW is the time to be a buyer of stocks.

True Market Insider

support@truemarketinsiders.com

Toll Free: 855.822.0269

South Florida Health and Wellness Magazine Health and Wellness Articles

South Florida Health and Wellness Magazine Health and Wellness Articles